“Corporations have to pay their fair share!”

“Fifty percent of the people in the U.S. don’t pay any federal income tax at all!”

“Millionaires pay less tax than their secretaries!”

“The U.S. has one of the highest corporate tax rates in the world!”

With these bromides passing as political discourse, we are once again driven apart by the political candidates. Even the so-called “fact checkers” are in the pockets of one or the other candidate or party. Is it simply impossible to bridge the chasm? Perhaps not; let’s try to reason this out together by starting with some axioms that (perhaps) we can all agree on…

- As nice as it might be to return to the pastoral days gone by, the federal government has woven its way into almost every aspect of daily life. This is unlikely to change quickly, so let’s take it as axiomatic that we have to keep financing the government. (Reducing the size of government can be left to another day.)

- Since it’s inception in 1913, income taxes have usually been progressive in the sense that the more money you made, the higher the percentage of income you would pay. (Again, let’s not quibble over the use of “progressive” here.)

- Corporate officers have a fiduciary responsibility to act in the best interests of the corporation for which they are an officer.

Starting with these premises, let’s see if we can’t create a philosophically justifiable approach to taxes.

Reduce corporate taxes to zero, increase the individual tax rate to a maximum of 100%.

When someone makes a statement about “greedy corporations,” they are in essence saying that the corporate officers acted in such a way to maximize the profits (read: well being) of the corporation. In other words, they were upholding their fiduciary responsibility. If you are against the notion of making a profit, then we will have to change the laws that allow for profit-making corporations — good luck with that.

So, when a CEO uses existing tax laws or moves a manufacturing plant to another country in order to maximize profits, that CEO is just doing his or her job. Can we reasonably expect anything else? If a CEO makes decisions which are bad for the corporation, she or he will be fired, perhaps sued, and (probably not but) criminally prosecuted.

However, all the people in a corporation (including the corporate officers) are individual citizens of somewhere. If we keep the companies in the U.S., then there will be more people to pay taxes.

The best way to keep the corporations in the U.S. is to make it economically viable to do so. Otherwise, it’s the obligation of the officers to look elsewhere.

Therefore, the corporate tax rate needs to be zero. But wait! All these corporate “fat cats” get a free pass? No; read on.

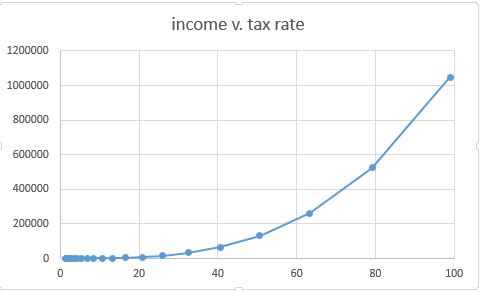

If you’re worried about “fairness,” how about increasing the top individual tax rate to 100%? For example, we could set the tax rate to a curve such that $1 million in income (not assets!) was taxed at 100%. This effectively would mean that no one could earn more than $1 million per year, because the rest of it would go to taxes. This would include dividends, interest earned, and capital gains.

The details of the shape of the curve and the top tax bracket would need to be worked out.

Of course, these would be the marginal tax rates; someone who earned $1 million dollars would only pay 100% on the last dollar earned. The top tax bracket would have to be automatically adjusted for inflation (without the need for new legislation or administrative law) every year to make it viable (this was the problem with the alternative minimum tax). In addition, all deductions would need to be eliminated.

Why would this work? If officer salaries are essentially capped at $1 million dollars and there are no taxes to pay, there will be more money in the corporate coffers to pay more employees. Instead of amassing cash, people could begin to look for other ways to self-actualize (like taking more time off to spend with family, do charity work, write a blog, etc.). This will lead to more jobs, therefore more income, and therefore more tax revenue.

Of course, those who insist on measuring their self-worth by how much cash the can amass will probably have a kind of crisis of conscience, but who gives a crap about them? 🙂